Managing your credit is a big part of maintaining financial health, and right at the center of it all is your CIBIL score. A good CIBIL score does not only improve the chances of loan approval but also ensures better interest rates and loan conditions. If you are left wondering about how to check CIBIL score online, then this is it-the place you’ve been searching for. In this article, we are going to walk through it, in detail, mentioning also the importance of monitoring a regular basis score.

Why is It Important?

It goes without saying that managing credit is a very essential element of being financially fit, and your CIBIL score is the pivot of this process. A good CIBIL ranking not only ups your chances of getting the approval to loan but also receives better interest rates and loan conditions. If you are guessing how to check CIBIL score online then you have finally landed at the right place. This guide will walk you through it step by step, and we’ll go over why you need to keep a close eye out for your score.

CIBIL Score: What Is It?

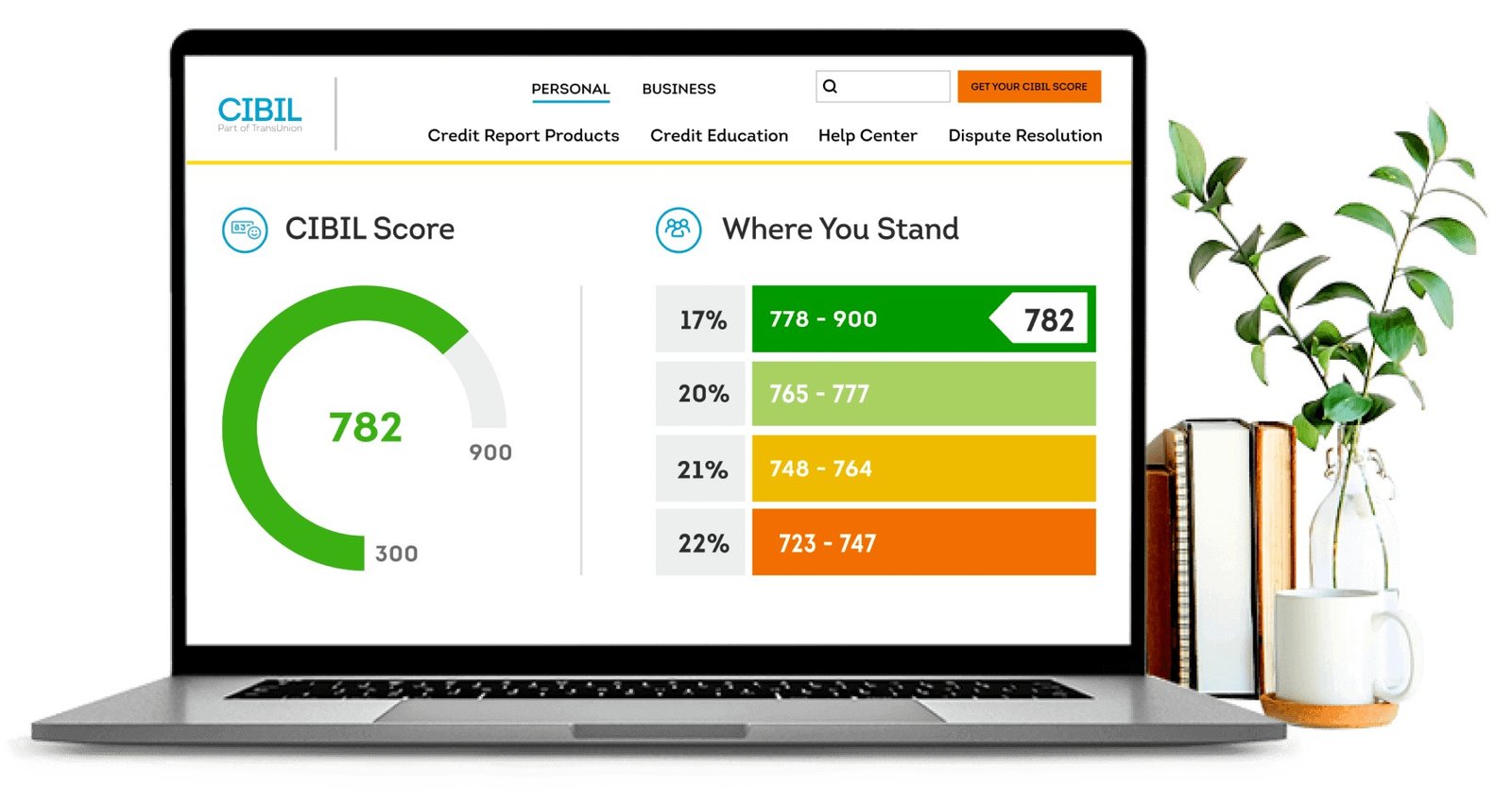

The three-digit CIBIL score reflects your creditworthiness; it ranges from 300 to 900. It is calculated from the history of credit and repayment behaviour. A good score can be 750 and above; it may hint at being a good borrower, hence banks and financial institutions will consider your applications for loans and credit cards with superior offers.

A good CIBIL score provides a number of benefits, some of which are listed below:

- Faster Loan Approvals: Applications with higher scores are very likely to get approval faster.

- Lower Interest Rates: You can negotiate better interest rates with a good credit score.

- Higher Credit Limits: This in most instances reflects lenders who will feel more confident offering greater credit limits.

- Better Loan Terms: You get access to longer repayment periods and other favourable terms.

Checking Your CIBIL Score Online: A Step-by-Step Approach

Here’s a step by step guide:

- Log in to the Official CIBIL Website Go to the official CIBIL website, where you will find a credit score-checker option. Click the option that says “Get Your Free CIBIL Score & Report.” You would be taken to a page requesting your identity information.

- Access and Provide Your Personal Information You will be required to fill in your name, email address, mobile number, and date of birth. Please fill in your information as accurately as possible because the same shall be used for identification and verification purposes.

- Verify Your Identity After filling in your details, an OTP will be sent to you on your mobile number. Use that OTP to move forward with verification.

- Continue to View your CIBIL Score After your identity has been successfully verified, you will be taken to the dashboard that will display your CIBIL score. The details of your score along with your entire credit history can be viewed.

Understanding Your CIBIL Score Range

Your CIBIL score runs within a scale of 300 to 900, with 900 being the highest. Let me break down what each score range means:

- 300-549: Those who fall within this category generally have records of late payments or defaults. It is very difficult to get the loans or issuance of credit cards approved if one’s score falls under this category.

- 550-649: A Fair Credit grade is the indication that, though you have tried to improve your credit, you are still some way off to get good loan terms.

- 650-749: Good credit-the lenders will consider lending to you, but not always at the best interest rates.

- 750-900: This is the ideal range of credit score. It reflects responsible credit management and qualifies you for the best loan offers and interest rates.

Why You Should Keep a Regular Tab on Your CIBIL Score

Keeping an eye on your CIBIL score is important, especially when you plan to apply for loans or credit cards. Here’s why:

- Avoid Surprises: You apply for a loan, then suddenly discover your score has dropped due to some long forgotten missed payment. Regular monitoring avoids all such last-minute surprises.

- Improve your creditworthiness: You’ll know about your score and thus be able to work on improving it by clearing dues or reducing credit utilisation.

- Early Error Identification: Sometimes, errors in credit reports are the cause for your low scores. Monthly checks will help you to identify discrepancies and raise disputes with CIBIL.

- Avoid Hard Inquiries: When lenders check your score as part of a loan application, it results in a “hard inquiry,” which can slightly reduce your score. Pulling your score yourself does not affect it and helps you keep informed about your standing.

Tips to Improve Your CIBIL Score

If your CIBIL score were less than perfect, do not worry. Following are ways in which it can be improved:

- Pay Your Bills on Time: Late payment is one of the most influential factors that have an impact on your score. Make sure you pay your loan EMI’s and credit card bills on or before the due date.

- Keep Credit Utilisation Low: Limit it to 20 percent or 30 percent of the available credit limit. A highly utilised credit line may result in poor scores.

- Maintain a Good Combination of Credit: Lenders look forward to borrowers having a good mix of secured credits, such as home loans and unsecured credit like credit cards.

- Avoid Multiple Loan Applications: Each time a person applies for a loan, there is involvement in a hard inquiry, which pulls down their score. A person needs to be very strategic and not apply for too many loans at one time.

How “Stashfin” Helps You Keep a Good CIBIL Score

People in need of short-term loans or flexible credit lines from time to time find platforms such as Stashfin as truly workable solutions. The personal loan and credit line facilities are quick and effortless on Stashfin; you can, over time, build better credit scores by being responsible with their services. Payment of dues on time with low utilisation on the credit lines will exponentially help increase your CIBIL score.

Endnote

Your CIBIL score reflects your financial reputation. Checking CIBIL scores online from time to time is an important part of maintaining a good credit profile. You can check your score sitting at your home in just a few simple steps, mentioned above. Remember, one should be tracking their score on a regular basis to ensure that it works in their interest.

It be for applying to any kind of loan or just to keep your financial health in good shape, maintaining a good CIBIL score is the key. If one wants a fast loan to increase their credit, then platforms such as Stashfin work flexibly and reliably.